Over the past several months, customers of DTE Energy and Consumers Energy have heard their investor-owned utilities make big promises to close coal plants and invest in more renewable energy. DTE Energy CEO Gerry Anderson was even awarded the Climate Leadership Award from the Center for Climate and Energy Solutions for the utility’s plans to reduce carbon emissions. Many of these statements occurred as the utilities faced a potential ballot initiative that would have increased the state’s renewable energy standard from 15% by 2021 to 30% by 2030, which both utilities opposed. However, the two utilities recently reached a compromise with the ballot’s sponsor, Clean Energy Healthy Michigan, and have promised to achieve a 50% by 2030 clean energy goal.

The 50% clean energy goal is really a 25% renewable energy requirement plus a 25% reduction in energy use that both Consumers Energy and DTE Energy pledged to achieve. In exchange, Clean Energy Healthy Michigan agreed not to submit the signatures it collected in support of placing the 30% by 2030 renewable energy standard on the November ballot.

The new targets won’t be binding, as they would have been if the initiative had passed, but in just a few weeks, the public will be able to gauge if one of the utilities is serious about its new pledge, when Consumers Energy files its first integrated resource plan (IRP) – a roadmap of how the utility plans to meet future electricity needs.

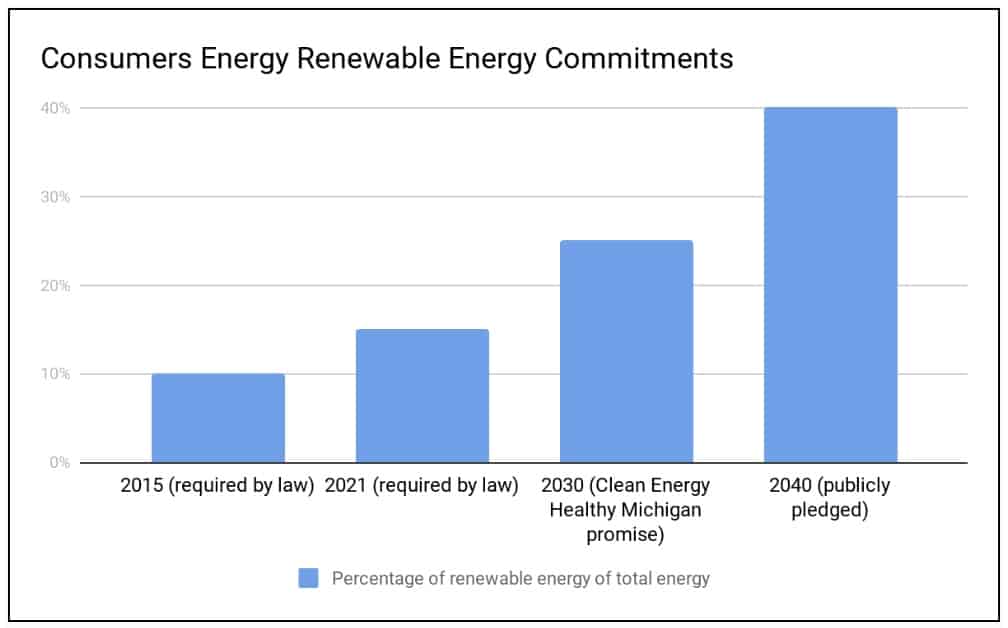

Consumers Energy’s IRP should also take into account its pledge from earlier this year when it publicly announced that 40% of its total electricity will come from renewable energy sources by 2040 in the utility’s efforts to cut carbon emissions 80% by 2050.

The IRP filing, which is required as a result of 2016 energy legislation and then was followed by an almost year-long MPSC rule-making process, will detail individual utility resource plans for a minimum of twenty years with specific 5-year, 10-year, and 15-year projections. The forecasts will contain several modeling scenarios – all of which should include the commitments it made to customers as part of its deal with Clean Energy Healthy Michigan. In other words, Consumers Energy’s forthcoming IRP should detail several scenarios of how it expects to achieve the 15% by 2021 renewable energy standard that is mandated by law, the 25% by 2030 promise with Clean Energy Healthy Michigan, and the utility’s own 40% by 2040 pledge.

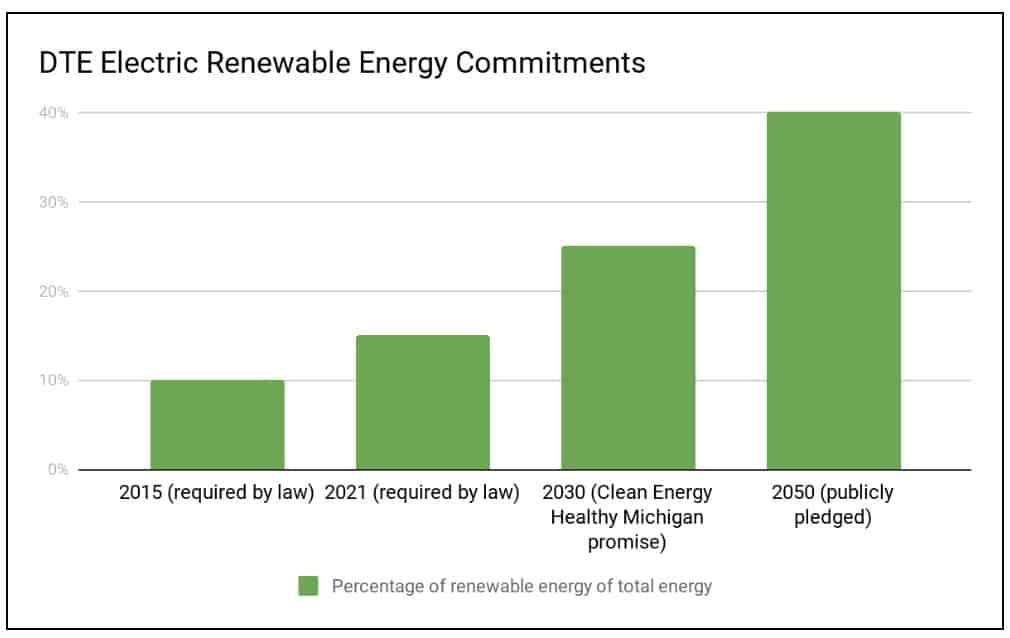

Stakeholders will have to wait ten additional months to find out how serious DTE Energy and CEO Gerry Anderson are about not only meeting the promise it made as a part of the new 2030 commitment it just made but also its earlier pledge to customers that it would close all of its coal plants and have 40% of its power come from renewable sources by 2050. The company’s electric subsidiary, DTE Electric, is scheduled to file its IRP on March 29, 2019.

The IRP process will involve the three commissioners and MPSC staff along with additional stakeholders analyzing the different scenarios forecasted by the utility. These forecasts must include multiple assumptions related to load growth, fuel prices, generating resources, energy waste reduction, demand response, along with other variables such the degree to which costs will continue falling for solar along with large and small-scale battery storage.

All of these topics will need close scrutiny in the IRP process, especially since both investor-owned utilities will be retiring their coal units over the coming years and might be inclined to shirk their renewable energy promises in favor of natural gas. The utilities are only bound by law to the 15% renewable energy standard. That’s especially true for DTE, given the growing profits it’s made in recent years from its massive gas investments. For all the promises they’ve made on top of that, the IRP filings will allow customers to find out just how serious their utilities are at keeping their word.

Here are five things to look for in Consumers Energy’s June 2018 and DTE Electric’s March 2019 IRP:

1. How much natural gas will utilities forecast?

DTE Electric recently received approval to build nearly a billion-dollar, 1,100 megawatt natural gas power plant in East China Township. The utility justified the plant as way to reduce carbon emissions and to meet baseload power demand when it retires three coal-fired plants at River Rouge, St. Clair and Trenton Channel between 2020 and 2023. The certificate of need process along with the approval had been controversial. In fact, Michigan State Representative Gary Glenn, chairman of the House Energy Policy Committee, filed Freedom of Information Act (FOIA) request for specific emails, calendar items, text messages and other information between the commissioners and DTE Energy along with the American Gas Association.

According to Rep. Glenn’s press release, MPSC staff members testified that DTE Electric had not modeled options that are achievable and cost-effective, specifically cost-efficient approaches to save ratepayers money.

“The commissioners chose not to heed those warnings even though they could have sent DTE back to the drawing board to run more models and make sure ratepayers saved money,” Rep. Glenn said. “The commissioners ignored the information they were presented and sided with DTE.”

DTE Electric has indicated it wants to build another natural gas plant to meet demand by 2030, but the commissioners (whose terms expire between 2019 and 2023) said they hoped DTE would find other alternatives to more gas plants.

Consumers Energy likely watched the certificate of need process develop over the past year, and it will be telling if it also wants to proceed with natural gas development.

Meanwhile, Rocky Mountain Institute, a nonpartisan nonprofit, recently published a report that issued a warning to regulators, utilities, and investors over the continued approval of natural gas infrastructure since the price of renewable energy and storage continues to decline. The RMI authors write, “To mitigate stranded asset risk and minimize ratepayer costs, investors and regulators should carefully reexamine planned natural gas infrastructure investment … the $112 billion of gas-fired power plants currently proposed or under constructions, along with the $32 billion of proposed gas pipelines to serve these power plants, are already at risk of becoming stranded assets.”

2. Will utilities ignore staff requests and utilize poor models in their forecasts?

During DTE’s natural gas certificate of need process, intervenors filed testimony that showed that the utility’s modeling was inadequate in demonstrating that the natural gas plant was the most cost-effective option to meet demand. Clean energy advocates used the same software that DTE uses in its own models and argued that the utility can save consumers $339 million over a 25-year period by using a portfolio of renewable energy and energy efficiency instead of building the gas plant.

MPSC staff also concluded that DTE Energy’s analysis was poorly done. Staff said DTE “should have used higher prices in its natural gas high price case” and that by not considering the risk of higher gas prices, “this could mean that the company’s proposed project is not the most reasonable and prudent choice.”

Furthermore, MPSC staff at one point asked DTE to run specific models in order to find different scenarios to save ratepayers money, but the utility at first refused to do so. When DTE finally did, it did not complete the models in a timely manner, preventing staff from fully evaluating the actual results. The commissioners reprimanded DTE for its behavior during the process — despite approving the plant.

Wow. Commissioners really railing into DTE officials. Cite bullying, humiliating behavior

— David Eggert (@DavidEggert00) April 27, 2018

To clarify, Michigan regulators today took DTE to task for alleged inappropriate writing/tone in legal briefs. It doesn’t sound like people were yelling and screaming in a room or anything. But PSC also not happy that DTE didn’t provide info it wanted or made it hard to get info

— David Eggert (@DavidEggert00) April 27, 2018

During the IRP rule-making process that took place in 2017, the commissioners ruled that while utilities will not have to share their software license or purchase a license for intervenors to run their own models to compare forecasts, the utilities will have to provide to the intervening parties all of their modeling data and assumptions. This will help intervenors run their own forecasts to scrutinize the utility’s forecast.

Nevertheless, a situation could still arise in a forthcoming IRP process similar to DTE’s recent certificate of need process in which a utility either drags its feet in supplying the requested data and/or runs inadequate forecasts to skew the math in favor natural gas over renewable energy.

3. How will utilities forecast renewable energy through PURPA?

During DTE’s certificate of need process, the utility failed to include the growth of PURPA contracts in its forecasts. PURPA, short for the Public Utilities Regulatory Policy Act of 1978, has been a major driver for solar energy in many states as it has required utilities to purchase electricity from small renewable energy facilities instead of building their own power plants or delaying the need of plants. Intervenors also noted that PURPA solar facilities could have displaced the need for some portion of DTE’s new gas plant and served as a hedge against gas price volatility. DTE has also been refusing to sign new PURPA contracts with solar projects claiming that it doesn’t need the electricity.

Consumers Energy, meanwhile, is also holding up the implementation of PURPA renewable energy projects in its own service territory, prompting a renewable energy company, Cypress Creek, to file a legal response with the PSC earlier this year against the utility. According to PV Magazine, Cypress Creek says that it has 700 megawatts of solar projects under development in the state, all of which could be stalled if regulators side with the utilities.

The IRP filing, as previously mentioned, will force utilities to model several new generation technologies as well as available options to purchase power, so it will be difficult for a utility to outright ignore the availability of renewable energy sources through PURPA as DTE Energy did – that is unless the utilities forecast scenarios in which the policy no longer exists. In fact, the utilities’ trade association, the Edison Electric Institute, is lobbying Congress to essentially end PURPA. And DTE and Consumers are among the largest donors to Rep. Tim Walberg, the sponsor of the bill to end PURPA.

4. How will the utilities forecast distributed generation following the PSC decision to dismantle solar net metering?

Instructions for the upcoming IRP filings include a specific section for utilities to project both planned solar and solar plus storage. However, last month, the commission ended the state’s net metering policy by issuing an order that changed how residents are compensated for electricity generated through solar. The decision sets up a billing system where rooftop solar customers buy energy at the retail rate, but sell electricity at an avoided cost rate that will be developed during upcoming utility rate cases. Numerous reports have rebutted the industry’s efforts at reducing the compensation rooftop solar customers receive; one from the Environment America Research & Policy Center analyzed 16 studies and concluded that solar customers do not have a negative effect on non-solar customers and generally deliver greater benefits to the grid and society than they receive through net metering rates.

Following the decision, the Michigan Conservative Energy Forum, an organization of conservative clean energy advocates, released a statement saying, “MCEF is dismayed by the indefensible action taken today by the Commission, and frustrated that the MPSC ignored the input of so many stakeholders in the work group. The order reflects a capricious lack of respect for the law and demonstrates just how much sway the utilities have over their own regulators.”

Michigan utilities have already been favoring wind energy as the preferred generation source to meet the state’s current renewable energy standard. There will likely be a negligible amount of rooftop solar projected in upcoming IRPs and the utilities are likely to inflate the costs or rooftop solar, as has become common practice for monopoly utilities. It will be vital for regulators to scrutinize the costs associated with rooftop solar and storage and interrogate the utility forecasts – especially since the price of residential solar systems continue to decline.

5. How will the utilities achieve a 25% reduction in energy waste?

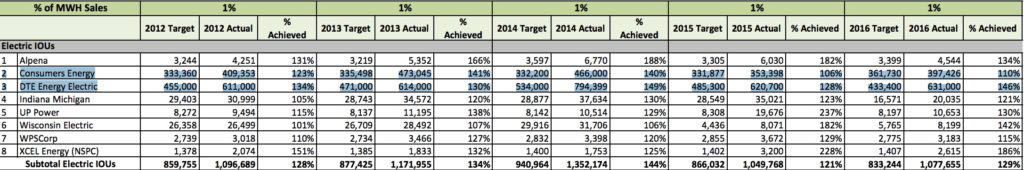

A section of the IRP filing requires utilities to specifically detail total megawatt reduction potential for each utility’s energy waste reduction programs. Before the newest commitments the utilities made, DTE Electric and Consumers Energy had been required to implement energy efficiency measures to achieve 1% reductions in annual energy savings each year through 2021. The requirement has been in place since 2008, and a recent report released by the MPSC has found that for every dollar spent on these programs, customers realize benefits of over $4.00.

DTE and Consumers Energy have not detailed the specifics of how they will continue to achieve energy reductions as part of their new commitment, or if the new 25% promise is the sum of all annual savings since 2008. However, an MPSC report has noted that both DTE Electric and Consumers Energy have continued to exceed the energy efficiency targets, which makes the upcoming IRP filing incredibly important to hold the utilities accountable to the 25% promise.

February 15, 2018 MPSC Report on Energy Waste Reduction Programs – Appendix B